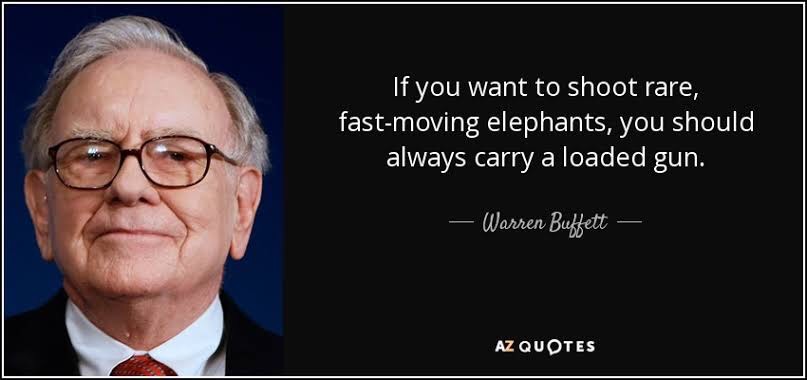

In his letter to Berkshire Hathaway shareholders in 2011, Warren Buffett wrote about the need for major acquisitions to maintain growth in the company’s non-insurance businesses.

“We’re prepared. Our elephant gun has been reloaded, and my trigger finger is itchy.”

Buffett said “Berkshire is contributing “something between” $12 and $13 billion of the deal”, so there’s plenty of cash available for another big acquisition if he finds one.

————————————————————

The news that caused a lot of discussion over the weekend was that Berkshire Hathaway sold more than 50% of their Apple stock for more than $78 Billion taking their cash pile to $277 Billion.

Warren Buffett called it Elephant Gun back in 2011, with $12-13 Billion for acquisitions.

Today he has $277 Billion in cash.

Not sure what weapon analogy can be used today.

Is he preparing for market crash? Or is he the one who will cause the market crash with such a huge sell-off and signal to the market?

Leave a comment